How to Avoid Probate Potholes

Most people do not realize the incredible complexity and time invested in a typical probate proceeding. Often, clients come to us thinking that the process of honoring the decedent’s will is about getting assets to appropriate beneficiaries as quickly as possible, when in reality probate is about ensuring that taxes, creditors and other interested parties are paid prior to the beneficiaries receiving any money. A statutory waiting period for 5-9 months (depending on the state) usually applies to all payments to beneficiaries, once the probate petition has been drafted and filed and approved, which can take several months.

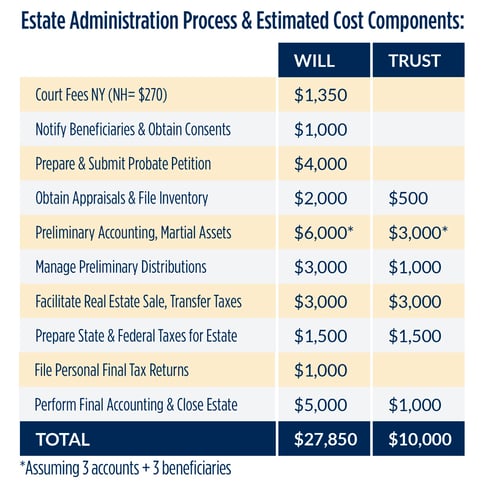

Estimated Savings With a Trust = $17,850

The data on the left assumes things run smoothly. Factors leading to additional costs include:

• Multiple Accounts

• Large Number of Beneficiaries

• Disputes over Bequests and Litigation

• Environmental Problems

• Missing Beneficiaries/Genealogical Research

• Extensive Creditor Claims

• Delinquent Income Tax Compliance

• Real Estate Title Issues

• Judicial Accounting, if required

• Charitable Bequests and Attorney General Intervention

Opportunity Cost:

While this money is tied up in an estate, you cannot use it to:

• Pay down mortgage loans

• Pay down car loans

• Pay down student loans

• Pay down credit cards

• Invest

The opportunity cost on a $1M estate might be close to $5,000 per month while it is open. Larger estates would likely be proportionally greater. A typical probate proceeding lasts 1-2 years and sometimes longer, whereas a well-drafted trust can largely be distributed in a matter of months. What do you want your legacy to be? Headaches and bureaucracy or speed and efficiency? Let us help you design an estate plan that steers clear of probate potholes. Please also refer to our Will vs. Trust Worksheet at: www.docrlaw.com/how-trusts-save-you-time-and-money

DID YOU KNOW? Right now, only 1 out of 11 calls are getting through to the IRS. As a result, administering estates can be even more costly and time-consuming. A trust can help you avoid taxes and the necessity of paying someone to keep you on hold for hours. For more information, follow: www.politico.com/news/2021/02/16/irs-tax-season-469182

May 26, 2021

A Guide to Widowhood

This is a guide for what to do now when you are 1) happily married and 2) hear about someone losing their spouse, and 3) it causes you to worry about what you would do if the unimaginable happened.

First and foremost, I hope it never happens to you. Your spouses’ death is going to throw your life into chaos no matter what. Whether you have been expecting it or it comes as a complete shock, you will likely be an emotional wreck. Even if you were hoping for his or her death as a release from suffering, you would have a lot to deal with from yourself and others like children, family, and friends. So, take some stuff off your future plate by thinking a little about it right now.

Note: this is also good to do if both you and your spouse happen to perish together and leave behind children, pets, or a company full of employees. If you have lived the kind of life where someone cares about your passing, you will need to give it some thought and put a few easy-to-execute plans in place.

Long before my husband died, I thought about his death, but I never imagined it would happen, nor were my imaginings of what it would be like anywhere close to accurate. I always assumed he would also pass before me, but I figured I would have him well into his 70s, if not 80s at least. So it came as a huge shock that he was one of the first 16,000 Americans to die of COVID-19. I never saw that one coming. How does anyone see that coming? I barely knew it existed before I lost my husband, best friend, soul mate to it.

In the aftermath, I was prepared, and that helped tremendously. Even though it was a huge shock, I had been through an untimely death before with his father. I had done the majority of paperwork and coordination for him so that he had to do nothing but grieve his father’s tragic passing. Because of that, I knew that I had to claim his body by going through a local funeral home. I had learned how important it was to get the death certificates right and to get several copies.

Because I had been in charge of the family finances, I knew all of the bank accounts as well as any investment and retirement accounts he had himself, and we had jointly. Because I had thought about his death long before he died, and because his mother had been a bank branch manager and seen many helpless little old ladies have no idea about the family finances, we had set up the accounts to pass through to me without needing any probate. Because we had been in the military where a will was required, not suggested, we had one in place.

Shortly before he died, he told me whom he wanted me to call about his valuable collections should anything happen to him. He also told me how much I should try to sell his motorcycle for if he should die. That was another opportunity for me to tell him that he was worth more to me alive than dead. I had no idea that I would actually need to know that information.

What we never talked about was anything regarding a memorial or funeral planning. Because we had gone through his father’s passing, I assumed he would want a cremation just like his dad and to scatter his ashes together with his dad’s. I don’t worry too much about what he wanted because I feel like those things are more for the living left behind than for the person who has passed. But if you or your spouse don’t feel the same, then you should definitely talk about that while he is above ground.

While you are at it, make sure that you are also listed on all the utilities so that you don’t have to work too hard to act on your own behalf to keep your lights on and your cell phone going. If everything is in his or her name, that is one extra step you have to go through.

One of the most important things I could say is to get term life insurance. It doesn’t cost that much because most people do not die before it expires. Usually, you get it while you have children at home and building your nest egg. Because he had term life insurance, it allowed me to do nothing aside from grieving his loss. I could stay in the house where we lived, and I didn’t have to pack everything up or go through his stuff. Life and all the comforts of our home stayed intact. That allowed me and our daughters just to exist until we could breathe again, eat again, sleep again. I can’t imagine how much more heartache there would have been for us had we had to vacate our home in a hurry.

The biggest reason I am sharing this is I wish to minimize the number of people whose lives are thrown into such a crisis from the loss of their mate. Parents, do this for your children. Think through these things so they don’t suffer more than they already will at your passing. Designate who their guardian will be if both you and your spouse pass. Get that life insurance so those you leave behind will be okay and able to grieve your loss.

Please don’t spend a lot of time imagining what it would be like to lose your spouse. Please go on enjoying your lives together and not being able to imagine spending it with anyone else. But do take a bit to make sure that you have some things in place in case the worst thing ever happens to you.

May 18, 2021

Key Takeaways & Strategies for a Brave New World

Never before has the term, “Happy New Year” rung with such a profound sense of hope and relief. Throughout 2020, we navigated the countless challenges and transitions that COVID-19 forced upon us. Even alongside a tumultuous and anxious landscape, we’ve gained precious insights into our daily lives and habits. We’ve come to terms with the fragility of our sense of control, and—perhaps most importantly—where our true priorities lie.

The Power of Places and Faces

For so many of us, our inherent need for human connection was revealed. We all utilize the subtleties of a smile and the warmth of a welcome handshake to build trust and reliance. Even brick and mortar buildings can provide the kind of legitimacy and stability one needs to make and complete difficult decisions. Without such interpersonal interactions, isolation can have a severe impact on our mental health. Most of our documents need multiple witnesses and notarizing. This is just one of the

reasons why we decided to keep our offices open safely. Our aim to provide guidance and expertise on some of the most significant decisions our clients could make in life are our number one priorities.

A Boom for Zoom

When the practice of social distancing removed us from our offices and other public spaces, technology tried quickly to fill the gap. In a matter of days, people of all backgrounds and abilities acclimated to online platforms and ordered deliveries. In many ways, this shift was rewarding as we have seen an increase in independence for seniors and an increased interest in lectures and online learning. Industries have utterly transformed in response to the pandemic, in some cases irrevocably and in others, fantastically and quite successfully. From retail operations moving to curbside shopping and pickup, to hospitals and healthcare providers transitioning to telehealth in order to continue access to preventative care and other services, there is much to learn and reap from these inventive methods. Even so, a backdrop of struggle and collapse accompanied 2020, as childcare bottlenecks forced some parents out of the workforce. The painful limits of remote learning, and the overwhelm hospitals and healthcare workers faced were part of our daily lives. We have yet to see just how far-reaching the effects of COVID-19 will be on our society and our economy.

Preparation is the Antidote to the Unknown

Unfortunately, we can’t talk about a new year without talking about the budget deficit. We anticipate an aggressive regulatory environment for addressing the growing imbalance between tax receipts and expenditures. What has been ongoing for quite some time now has rapidly accelerated in the last year. Ultimately, someone will have to pay the piper. Whether that comes in the form of higher taxes in the short term, a reduction in entitlement spending, or a kicking of the can even further down the road via refinancing, the debt needs to be repaid. Tax increases are highly likely to happen, and this is where we can help you. Though we do not yet know what future policies will look like, the more we explore creative tax savings scenarios and prepare for longevity and higher costs, the closer we will be to the optimal strategy when new policies are enacted. So, do not be scared, but do prepare. Let us help you manage the unknown and make smart decisions as we forge ahead into a brave new world, together.

January 18, 2021

News, Tax Savings, Tax Exemption, Estate taxes

Retirement Landscape: Estate Taxes

The quality of your retirement can be impacted by state-level taxes, such as income, sales and property taxes. Taxes tend to lead to inflation, meaning the cost of living trends higher in high tax states. Your spending power will thus be greater in states with low state taxes. Retiring in a state with high taxes, such as California where income taxes alone range up to 13%, means paying a large chunk of your retirement income to the state, diminishing your spending power. Consider how you plan to spend during retirement; do you prefer to make your home a vacation destination for others, or do you want to be the one travelling? If the latter, putting down roots in a small home in a state with low taxes may give you the financial freedom you want to see the country or the world.

Still another factor to consider is the taxes payable upon death, commonly called estate taxes or inheritance taxes. An estate tax is based on the value of the decedent’s gross estate (all the real and personal property the decedent owned); whereas an inheritance tax is based on the relationship between the decedent and the beneficiary. The chart on the right identifies the states with a state-level death tax. Estate taxes are highest in Washington, which currently has a 20% estate tax on estates over $11.2 million. Other tough tax jurisdictions include Vermont, New York, Massachusetts, Rhode Island, Maryland, Oregon and Hawaii. Retirees who have family in these states may benefit from maintaining a primary residence in a low tax state, with a second home in the higher tax state.

Six states have an inheritance tax: New Jersey, Pennsylvania, Maryland, Kentucky, Nebraska and Iowa. Although bequests to spouses are exempt from inheritance tax, bequests to children, siblings, nieces and nephews, cousins, or close friends may bear a high tax. Crossing the border to a state without an inheritance tax can save your loved ones hundreds of thousands of dollars. For example, a niece who inherits from an aunt who passes away in New Jersey with a $5 million estate will pay approximately $750,000 to the State of New Jersey; however, if the same aunt died a New York resident, there would be no inheritance tax liability.

Another way to take advantage of tax-friendly jurisdictions is by establishing a trust in that state. In New Hampshire, trusts are exempt from state-level income, sales and estate taxes. Consider again a woman living in New York or New Jersey with a $7 million estate. If she were to transfer her investments to a New Hampshire trust, her niece could inherit from the trust without having to pay estate or inheritance tax. Often people find that the tax savings they enjoy by establishing a New Hampshire trust more than pay for the costs and fees associated with setting up and maintaining the trust. Each individual’s circumstances are different. Working with your investment advisor and accountant, our attorneys can create a custom estate plan that will maximize your spending power in retirement and help you navigate your own retirement map.

January 18, 2021

News, Tax Savings, Tax Exemption

ACT BEFORE YEAR-END TO PRESERVE YOUR CURRENT ESTATE TAX EXEMPTION

Strategies to Reduce Gift/Estate Tax Uncertainty

Many of our clients have had their eyes on the election and may be rightly thinking about the need to update their gift and estate planning. There is already an open discussion about a rollback of the 2018 Trump tax cuts in the Biden camp. If Biden’s win is confirmed, and if those sympathetic to Biden’s policy proposals gain control of both houses of Congress, the current generous gift tax of exemption $11.58M, or $23.16M for a married couple, could easily be reduced by 50% or more. Currently, the balance of power will be decided by a run-off election for Georgia’s two senate seats, which won’t be decided until January 5th, potentially too late to make a decisive move.

To counter this uncertainty, consider a strategy that allows you to “freeze” the current generous gift estate exemption: the gift of a promissory note. An individual can promise to make gifts to donees in the future through such a gift. This promise to make the transfer in the future allows the donor/promisor to take advantage of the current $11.58M estate tax exemption, while still having possession and control of the funds or property.

Normally, a promise must be supported by some consideration and show mutual assent by the parties to be enforceable. Nevertheless, for gift tax purposes, a transfer may constitute a gift even if the property is transferred for less than adequate and full consideration in money or money’s worth. 26 U.S. Code §2512. Additionally, a gratuitous transfer of a legally binding promissory note is considered a completed gift even though the donor is solely making a promise to gift property in the future. Rev. Rul. 84-25. These gifts should be timely reported on a Form 709: “United States Gift (and Generation-Skipping Transfer) Tax Return.”

Whether this gift strategy will ultimately reduce the estate tax burden will depend in part on whether the taxpayer dies within 3 years of making the gift. If so, the IRS can successfully “add back” the tax burden to the decedent’s gross estate. Gifts made shortly prior to a person’s death are normally considered “gifts in contemplation of death”; in other words, a gift of property made by a person expecting to die soon. If the gift is considered to be made in contemplation of death, the gift will be included in the value of the decedent’s estate for federal tax purposes, which could result in taxation if the estate tax threshold is lowered significantly.

A potential solution to this issue may be a self-cancelling note. This instrument works similarly to a typical installment note, in that payments are made to a person or a trust periodically over a specified period of years. But, unlike a classic installment note, a self-cancelling note includes one or more provisions for automatic cancellation of the unpaid balance at the death of the seller/donor. Therefore, if the donor dies before the specified period, the property is transferred, and the value is removed from the decedent’s estate. If the donor lives beyond the period over which payments may be made, the “cancel at death” provision(s) are not triggered.

Some states have similar provisions to the federal 3-year-period explained above. One example is the State of New York, where there is no gift tax. Here, New York Tax Law § 954 (a) (3) includes in a New York resident’s taxable estate the amount of any gift made during the three year period before the decedent’s death, but not including any gift made: (a) by a non-resident of New York state; or (b) before April 1st, 2014; or (c) between January 1st, 2019 and January 15th, 2019; or (d) that is real or tangible personal property having an actual situs outside NY state at the time the gift was made. This provision is set to expire on January 1st, 2026, in line with current Federal law.

Another strategy is to make the promissory note payable to an irrevocable trust for the benefit of the donees. In this case, the donor could promise to pay or give property to a trust for the donee’s benefit. The note would then be delivered to and enforceable by the trustee of the trust. Even though the beneficiaries of the trust are the ultimate recipients, they should not be considered to have received an indirect gift to the trust for gift tax purposes. If the note is payable to a trust created by the donor, the trust could be structured as a grantor trust for income tax purposes. 26 CFR §1.671-2 (e) (2). Consequently, neither the donor nor the trust should be taxed on the interest on the note. Rev. Rul. 85-13.

Carefully implemented, this gift tax strategy can allow you to benefit from the current gift tax exemption, without losing control of assets, and may allow you to reduce your estate tax burden significantly. Contact us to see if this simple but effective strategy could be right for you.

November 16, 2020