New Year's Resolution, Medicaid

New Year's Resolution: Preparing for Medicaid's Five-Year Lookback

The new year brings an opportunity for resolutions to ensure future well-being and financial security. For many seniors and their families, understanding Medicaid's five-year lookback period is an essential part of that preparation. Let's delve into what the five-year lookback entails and how you can prepare for it as part of your New Year's resolutions.

What is Medicaid's Five-Year Lookback?

Medicaid's five-year lookback is a rule that applies to those seeking long-term care through Medicaid. When an individual applies for Medicaid, any gifts or transfers of assets made within the five years prior to the application date are scrutinized. If ineligible transfers are found, they can result in a penalty period during which the individual is ineligible for Medicaid benefits.

This policy aims to prevent people from reducing their assets simply to qualify for Medicaid coverage. The lookback period is intended to ensure that Medicaid helps those who genuinely need assistance after spending their own resources.

The Importance of Timely Estate Planning

Understanding the five-year lookback rule underscores the importance of timely estate planning. Engaging in proactive planning can help protect your assets and ensure eligibility when the time comes. Consider the following points:

- Asset Transfers: Gifting assets or transferring them to a trust can be a wise move, but it must be done with an eye on Medicaid's timeline to avoid penalties.

- Trusts: Irrevocable trusts can be an effective tool for managing assets outside of your estate, but they must be established and funded five years before applying for Medicaid.

- Legal Guidance: Navigating Medicaid rules can be complex, and missteps can be costly. Legal advice is invaluable in crafting an estate plan that aligns with Medicaid regulations.

Proactive Strategies to Consider

As you look ahead to the future, consider implementing these strategies to prepare for Medicaid's lookback period:

- Early Planning: Begin your Medicaid planning at least five years before you anticipate needing long-term care.

- Consult Professionals: Work with an elder law attorney to understand how the lookback period applies to your specific situation.

- Document Everything: Keep meticulous records of all asset transfers and financial transactions to demonstrate compliance with Medicaid rules.

Exceptions to the Rule

There are some exceptions to the five-year lookback that allow for asset transfers without penalty:

- Transfers to a spouse are exempt from the lookback period and do not incur penalties.

- Specialized trusts for a disabled child or grandchild can also be created without triggering a penalty.

- Transfer of a home to a caretaker child who has lived in the home and provided care, allowing the senior to avoid institutionalization, may also be exempt.

Penalty Period Calculations

If transfers are made during the five-year lookback period that do not meet exemptions, a penalty period may be imposed. The length of the penalty period is determined by dividing the value of the transferred assets by the average monthly cost of private nursing home care in your state. This calculation yields the number of months the individual will be ineligible for Medicaid.

Navigating the Lookback with Professional Help

Professional guidance is crucial in navigating Medicaid's complex rules. An elder law attorney can provide insights into strategies that may include:

- Purchasing annuities that comply with Medicaid regulations.

- Creating caregiver agreements that compensate family members for providing care without violating Medicaid rules.

- Utilizing Medicaid-compliant promissory notes.

It's also essential to be wary of advice that seems too good to be true or suggests circumventing the rules. This can lead to significant penalties and jeopardize your financial future.

Your Next Steps

As you make your New Year's resolutions, consider the peace of mind that comes with being prepared for Medicaid's five-year lookback. Early and thoughtful planning can secure your legacy and ensure you have the care you need when the time comes. Take action now to ensure your estate is in order as you enter the new year. Remember, the earlier you start, the more options you have. Let’s make this New Year’s resolution count for your peace of mind and security.

If you're looking to understand more about Medicaid planning or need assistance with your estate plan, our expert team at Donohue, O’Connell & Riley is ready to guide you through every step. Contact us today to discuss how we can help protect your future and your loved ones.

January 17, 2024

Tax Savings, Asset Protection, New Year's Resolution, Estate taxes, inflation

9 Strategies to Protect Your Retirement Savings From Inflation

January 18, 2023

Trust, Will, New Year's Resolution, Topic: News, Community

20/20 Focus: The Gift of Foresight as We Age

Having only recently gained 20/20 vision after being born severely nearsighted, Joe Donohue, managing member of Donohue, O'Connell and Riley, understands the value of clarity. For him, it's a gift. The ability to see clearly is something he's been working toward his entire life, both personally and professionally.

The ability to foresee what lies ahead as a person grows old gives him or her peace of mind. When it comes to preparing for the late-in-life trials and tribulations, having a clear plan is truly a gift to everyone involved. Statistically, most people will not die from a tragic, unexpected death, but instead the slow, degenerative nature of aging. Many of their lives will end in an institution with someone taking care of them.

Will You Be Prepared?

The sad truth is that many people are not prepared. They do not take the time to think ahead earlier in life when it matters most. Far too many people have not established who, if anyone, will be supporting them throughout the aging process, leaving them isolated and vulnerable.

Donohue remembers a striking example of an elderly husband and wife who died within a short time of each other. They were a symbiotic couple. She was hard of hearing, and his vision was weak; when he would drive, she would tell him when to turn. They did everything together but had nobody around to support them as they got older – and they had no plan in place. One day, the husband tripped and fell on the wife as they ascended the stairs. They both suffered head trauma, ended up in a nursing home, and died within six months of each other. What was supposed to be a simple outing turned tragic because they lacked a support network. They had nobody around to help them with simple chores and had made no arrangements for themselves as they aged.

Many older people need a lot of assistance to stay independent. They need someone to help keep up with the various bills that will continue to come no matter their ability to manage them. Too often, a medical emergency happens at night, and the elderly patient has to leave the house unexpectedly. Without a plan in place, the house is left unoccupied, which can lead to all kinds of added woes down the road. It's upsetting enough to deal with the trauma of a hospital visit but to have to deal with the further stresses of a burst pipe or a break-in only adds insult to injury.

Our estate, tax and elder law practice ensures that our clients have the appropriate documents in place, so there's always someone advocating for them. Our "Support Circle" strategy makes sure there will always be someone else who's aware of the "big picture." With over 100 combined years in practice, we have seen almost every scenario; our value to you is the foresight we've acquired. We'll help you gather all the necessary information, allowing us to provide you with a clear and bright path forward.

Visit our website or call Donohue, O'Connell & Riley at 844-50-TRUST (844-508-7878).

January 23, 2020

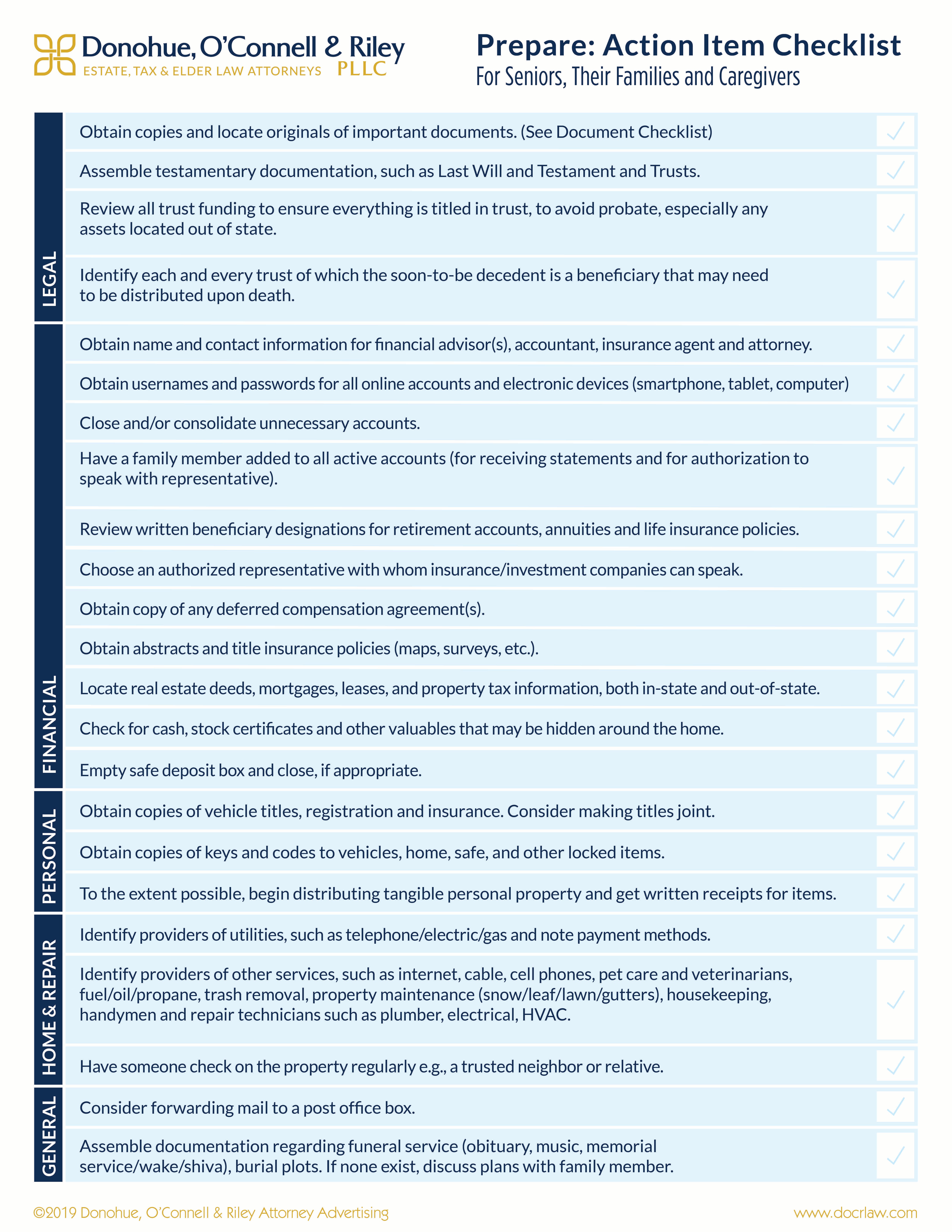

Whitepapers, Trust, Asset Protection, Will, checklist, New Year's Resolution

Prepare for the Road Ahead

The start of a New Year is a great time to plan ahead to save yourself and your loved ones time, money and stress. This easy-to-use checklist serves as a comprehensive guide for seniors, their families and caregivers as they consider all the legal, financial, personal and practical steps to proper advanced planning. We invite you to download and share this worksheet with anyone looking for an opportunity to live life to the fullest in the retirement years and prepare for the road ahead.

January 29, 2019

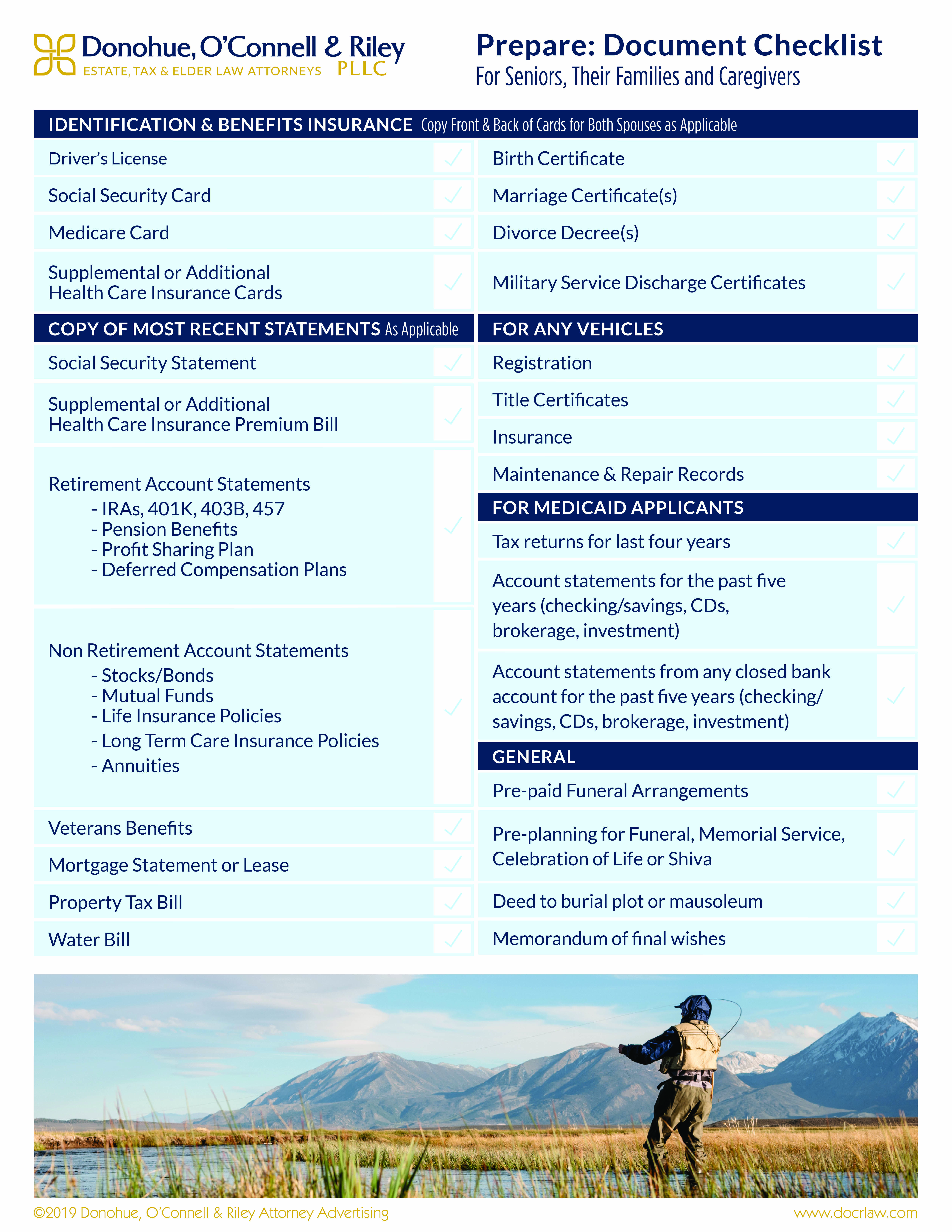

Whitepapers, Trust, Asset Protection, Will, checklist, New Year's Resolution

Resolve to Organize Your Affairs in 2019!

HAPPY NEW YEAR!

As you set goals and resolutions for 2019, organizing your affairs for peace of mind should be at the top of the priority list. Many clients and their families feel overwhelmed when they try to navigate the financial and emotional complexities of aging. We hope this Document Checklist gives you a solid foundation of helpful documents you’ll need to get your affairs in order, in the event of an unexpected health crisis. Please feel free to download and share with your family, friends and trusted advisors.

January 3, 2019