How to avoid New York's Fiscal Cliff

Like many states, New York has a progressive tax rate that starts at 3.06% for estates at or over $5.74 million and extends up to 16% for estates that exceed the exemption limit by $10.1 million or more. But unlike other states, if the estate exceeds the exemption level by more than 5%, the New York estate tax is applied to the entire amount of the estate, instead of just the amount over the limit.* The fact that all estate assets are subject to taxation beyond a certain level is known as the New York "Fiscal Cliff."

For example, in 2021 an estate worth $5.93 million would be subject to $0 taxation, but an estate worth $6.25 million would "fall off" the cliff and be subject to $542,000 in estate taxes to an increase of only $320,000. By employing one of the strategies below to stay below the exemption level, you can save your estate more than $500,000.

There are many ways our estate tax attorneys can help you avoid this cliff and safeguard your wealth. Some possibilities include:

1. Credit Shelter Trusts

Married couples can utilize credit shelter trusts, also known as A/B trusts. These are irrevocable trusts created upon the death of a married individual. Because a trustee manages the assets in such a trust, the decedent's assets are not added to the estate of the surviving spouse and can effectively double the couple's state-level estate tax exemption to $10.98 million. These trusts can also be designed to also allow the surviving spouse to maintain certain rights to trust income and assets during his or her lifetime for health, education, maintenance and support purposes. After the second spouse's death, the credit shelter trust is transferred to the next generation without being subject to estate taxes.

2. Non-Grantor Trusts

Non-grantor trusts are irrevocable trusts made during one's lifetime that can provide estate tax relief. In a non-grantor trust, the creator of the trust, the settlor/grantor, transfers assets to an independent trustee who has been designated to make decisions on behalf of the trust's beneficiaries. In exchange for giving up certain rights to control the disposition of trust assets, non-grantor trusts can provide trust grantors with more advantageous tax benefits than grantor trusts. You also can establish a non-grantor trust in a different tax jurisdiction from your residency. For example, a resident of New York can establish a non-grantor trust in New Hampshire, a state with no state-level income or estate tax, and protect assets that exceed the New York estate tax exemption from the "Fiscal Cliff".

Dynasty Trusts – Dynasty trusts are a type of non-grantor trusts that ease wealth transfer between generations. Assets allocated as gifts to these trusts are tax-free below the Generation-Skipping Transfer and Lifetime Gift Exemption limits – which were increased to $11.4 million per individual by the 2017 Tax Cuts and Jobs Act. Once part of the dynasty trust, assets are exempt from transfer taxation for the duration of the trust, which may result in estate tax savings for several generations.

3. Changing Your Domicile

Although they are often used interchangeably in colloquial speech, domicile, statutory residence and residence are distinct legal terms in the world of estate planning. Legally, your "domicile" is the state where you maintain your permanent tax "home". It determines where your will is probated and how your estate will be taxed. If you have such ties or property in multiple locations, it may be possible to change your domicile to the most tax-friendly state. It is important to consult with your estate planning attorney if you are considering a change in residence or domicile to ensure you arrange your affairs so that the relocation is respected by tax authorities.

4. Strategic Gifting

New York does not have a gift tax, which is a tax applied to gifts made during an individual's lifetime. This means that if you seek to minimize the amount of your estate, making strategic gifts to loved ones, rather than naming them as beneficiaries in your estate may be a wise course of action. Gifts given within the three-year period before your death, however, may still be counted towards the total amount of your estate and may not be exempted from an estate tax, so it is prudent to plan these gifts far in advance.

5. Charitable Formula Gifts

One excellent way to minimize estate taxation while aiding philanthropic causes, is to include a formula clause in your estate instrument specifying that any assets in excess of the New York estate tax exemption not being transferred to a spouse or credit shelter trust will be given to a charitable organization of your choosing. This protects your entire estate from falling off the "Fiscal Cliff," meaning that your heirs will receive more assets, and also avoids taxation on your charitable donation, thereby increasing the impact of your philanthropic legacy.

6. Discounted Valuation of Closely-Held Businesses

A family-owned or closely-held private business is often among the most valuable estate assets. If you are interested in minimizing your taxes, making lifetime gifts of closely-held business stock to your family members or heirs may be wiser than naming these individuals as the beneficiaries of these stocks. Transferring these stocks during your lifetime can help you to reduce income and estate taxes.

7. Discounted Values of Fractional Interest in Real Estate

Your interest in real estate is considered part of your taxable estate under New York law. Fractional ownership of real estate can enable you to become eligible for valuation discounts that are not available to individuals who possess full ownership of a property. This is due to the restrictions on your ability to market and control your asset that are inherent to partial ownership. Our attorneys can assist you in maximizing these discounts during your property valuation.

Prosperous families, professionals and business owners rely on us for personal service, creativity and results. We look forward to the opportunity to understand your unique situation, craft a bespoke plan and provide a valuable relationship over the years as your needs evolve.

*If the estate exceeds the limit by less than 5%, it is applied only to the amount of assets that exceed the limit. Note that when accounting for the taxable estate, the total value will include even “non-probate” assets such as your home, IRAs and life insurance.

January 7, 2022

How to talk to your loved ones about estate planning

Family members play an extremely important role in representing and advocating for their aging loved ones in both legal and healthcare matters. At first, it may be uncomfortable to discuss end-of-life wishes with those close to you, but you will all have peace of mind knowing that estate planning wishes and advanced healthcare directives have been addressed.

Begin the Conversation

Start by arranging a comfortable time and place to discuss their plans. Ideally, all adults involved in the care plan will be able to meet at the same time so all voices are heard with first-hand communication. Sometimes, an attorney’s office is an appropriate setting for this dialogue.

Will vs. Trust

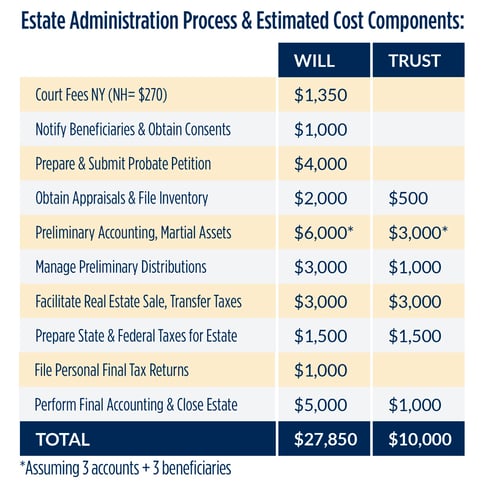

Do your parents have a will? A trust? Accounts with named beneficiaries, pay-on-death or transfer-on-death accounts? Joint accounts with rights of survivorship? Understanding these details while your parents are in full command of their intellectual abilities is essential for protecting their wishes for their well-being and their legacy. Your parents should establish a will, which will outline how they wish to bequeath their assets and belongings to beneficiaries. They may also want to establish a trust to hold assets and transition them to the next generation; minimizing taxes and probate costs. Please refer to these two charts for more information: Wills Vs Trusts Form and How Trusts Save You Time and Money

Advanced Directives

The following are important legal documents an attorney will prepare to outline your loved ones’ intentions in the event of an emergency such as incapacity:

Living Will – Provides specific instructions on whether your loved ones would like artificial life-sustaining medical treatments should they become permanently unconscious or terminally ill.

Durable Power of Attorney (POA) – Designates a specific individual as an “agent”, who is legally authorized to make decisions on behalf of the individual(i.e., your parent, aunt, uncle). The nature of these decisions can be specified within the power of attorney, but generally include the ability to represent the client in a legal and financial capacity.

Durable Power of Attorney for Healthcare/Healthcare Proxy – This specific kind of POA authorizes the proxy to make healthcare decisions on your behalf, if you're unable to.

Location, Location, Location

Advanced directives and other essential documents are only useful if they are accessible. Original documents should be stored in a secure, organized location, such as a fire-proof safe at the attorney’s office. Other important documents include copies of wills, trusts, and the advanced directives listed above; information on financial accounts; all non-employment income sources, including pensions, Social Security claims and retirement accounts; life insurance policies; titles to vehicles, homes and any other properties or assets; medical records; identity documents, including birth certificates, marriage certificates and Social Security cards; deeds to cemetery plots; and information on outstanding debts, credit cards, and any recurring expenses. If applicable, you’ll also want to have them list all online accounts with their usernames and passwords. You can use this handy document checklist as a guide: Document Checklist

Solving the Long Term Care Puzzle

If the thought of paying over $150,000 a year for nursing home care is daunting, you are not alone. Even the most diligent saver can begin to feel the strain after a few months or years of care. In addition, Medicare insurance does not cover long-term care.

One option for handling the cost is long-term care insurance. Rates for long-term care insurance vary based on the policy holder’s age, gender, health, type of coverage, daily benefit amount and benefit period, among other factors. Older clients can expect to pay more for coverage, and insurance companies may deny coverage for individuals older than 80 or those who have a chronic illness.

If your loved ones are unable to procure long-term care insurance due to health or financial reasons, another option to pay for care is Medicaid planning. This typically involves shifting assets into an irrevocable trust that can then be managed by you and/or your siblings. This option enables individuals to have their care covered by Medicaid while preserving assets they would like their loved ones to inherit, such as a house. Please refer to our long-term care puzzle https://bit.ly/3vcpAVX and schedule an appointment with one of our attorneys to position assets and reap the benefits of a clear flexible plan, even as puzzle pieces shift.

We hope these topics are a starting point to begin an ongoing conversation about how your loved ones wish to live life to the fullest on the road ahead and into the sunset years.

January 7, 2022

Michael Jackson’s Estate and the IRS in Tax Court: A game of ‘Beat It’

Michael Jackson, often referred to as “the King of Pop”, left us in June 2009. As expected, the Executors of his Estate filed an estate tax return reporting the value of various assets. The IRS audited the Estate’s return, and later issued a notice of deficiency that adjusted the reported values in May of 2013. Although the Estate and the IRS settled most of the valuation disputes, there was a disagreement as to the value of three assets: (1) Jackson’s right to publicity (“Image and Likeness”); (2) The New Horizon Trust II, which held his 50% ownership interest in Sony/ATV (which owned a large catalog of copyrights, among which were some 175 songs by The Beatles); and, (3) the New Horizon Trust III, which held copyrights to compositions written or co-written by Michael Jackson, as well as other songwriters.

The Tax Court was then left with the task of determining the fair market value of these assets at Jackson’s date of death. The fair market value for estate tax purposes is defined as the price at which the property would exchange hands between a willing buyer and a willing seller. Given the unique nature of Jackson’s assets, however, the challenged assets lacked a readily ascertainable fair market value. Ultimately, the Court concluded that the value of these three assets totaled $111,467,473. This was a dramatic decrease from the $481,866,964 valuation of the IRS’s expert at trial.

As we can see from the outcome of this opinion, valuation of assets is key to estate tax planning. In some cases, it is best to gift high-growth, hard to value assets earlier, and let them grow outside of your estate, rather than holding onto them. This strategy may allow you to moonwalk past the tax headache and enjoy the benefits of today’s unprecedentedly high gift tax exemptions.

Carefully implemented, this gift tax strategy can allow you to benefit from the current gift tax exemption, without losing control of assets, and may allow you to reduce your estate tax burden significantly.

Contact us to see if this simple but effective strategy could be right for you.

Click here for the the in-depth source article.

June 9, 2021

How to Avoid Probate Potholes

Most people do not realize the incredible complexity and time invested in a typical probate proceeding. Often, clients come to us thinking that the process of honoring the decedent’s will is about getting assets to appropriate beneficiaries as quickly as possible, when in reality probate is about ensuring that taxes, creditors and other interested parties are paid prior to the beneficiaries receiving any money. A statutory waiting period for 5-9 months (depending on the state) usually applies to all payments to beneficiaries, once the probate petition has been drafted and filed and approved, which can take several months.

Estimated Savings With a Trust = $17,850

The data on the left assumes things run smoothly. Factors leading to additional costs include:

• Multiple Accounts

• Large Number of Beneficiaries

• Disputes over Bequests and Litigation

• Environmental Problems

• Missing Beneficiaries/Genealogical Research

• Extensive Creditor Claims

• Delinquent Income Tax Compliance

• Real Estate Title Issues

• Judicial Accounting, if required

• Charitable Bequests and Attorney General Intervention

Opportunity Cost:

While this money is tied up in an estate, you cannot use it to:

• Pay down mortgage loans

• Pay down car loans

• Pay down student loans

• Pay down credit cards

• Invest

The opportunity cost on a $1M estate might be close to $5,000 per month while it is open. Larger estates would likely be proportionally greater. A typical probate proceeding lasts 1-2 years and sometimes longer, whereas a well-drafted trust can largely be distributed in a matter of months. What do you want your legacy to be? Headaches and bureaucracy or speed and efficiency? Let us help you design an estate plan that steers clear of probate potholes. Please also refer to our Will vs. Trust Worksheet at: www.docrlaw.com/how-trusts-save-you-time-and-money

DID YOU KNOW? Right now, only 1 out of 11 calls are getting through to the IRS. As a result, administering estates can be even more costly and time-consuming. A trust can help you avoid taxes and the necessity of paying someone to keep you on hold for hours. For more information, follow: www.politico.com/news/2021/02/16/irs-tax-season-469182

May 26, 2021

A Guide to Widowhood

This is a guide for what to do now when you are 1) happily married and 2) hear about someone losing their spouse, and 3) it causes you to worry about what you would do if the unimaginable happened.

First and foremost, I hope it never happens to you. Your spouses’ death is going to throw your life into chaos no matter what. Whether you have been expecting it or it comes as a complete shock, you will likely be an emotional wreck. Even if you were hoping for his or her death as a release from suffering, you would have a lot to deal with from yourself and others like children, family, and friends. So, take some stuff off your future plate by thinking a little about it right now.

Note: this is also good to do if both you and your spouse happen to perish together and leave behind children, pets, or a company full of employees. If you have lived the kind of life where someone cares about your passing, you will need to give it some thought and put a few easy-to-execute plans in place.

Long before my husband died, I thought about his death, but I never imagined it would happen, nor were my imaginings of what it would be like anywhere close to accurate. I always assumed he would also pass before me, but I figured I would have him well into his 70s, if not 80s at least. So it came as a huge shock that he was one of the first 16,000 Americans to die of COVID-19. I never saw that one coming. How does anyone see that coming? I barely knew it existed before I lost my husband, best friend, soul mate to it.

In the aftermath, I was prepared, and that helped tremendously. Even though it was a huge shock, I had been through an untimely death before with his father. I had done the majority of paperwork and coordination for him so that he had to do nothing but grieve his father’s tragic passing. Because of that, I knew that I had to claim his body by going through a local funeral home. I had learned how important it was to get the death certificates right and to get several copies.

Because I had been in charge of the family finances, I knew all of the bank accounts as well as any investment and retirement accounts he had himself, and we had jointly. Because I had thought about his death long before he died, and because his mother had been a bank branch manager and seen many helpless little old ladies have no idea about the family finances, we had set up the accounts to pass through to me without needing any probate. Because we had been in the military where a will was required, not suggested, we had one in place.

Shortly before he died, he told me whom he wanted me to call about his valuable collections should anything happen to him. He also told me how much I should try to sell his motorcycle for if he should die. That was another opportunity for me to tell him that he was worth more to me alive than dead. I had no idea that I would actually need to know that information.

What we never talked about was anything regarding a memorial or funeral planning. Because we had gone through his father’s passing, I assumed he would want a cremation just like his dad and to scatter his ashes together with his dad’s. I don’t worry too much about what he wanted because I feel like those things are more for the living left behind than for the person who has passed. But if you or your spouse don’t feel the same, then you should definitely talk about that while he is above ground.

While you are at it, make sure that you are also listed on all the utilities so that you don’t have to work too hard to act on your own behalf to keep your lights on and your cell phone going. If everything is in his or her name, that is one extra step you have to go through.

One of the most important things I could say is to get term life insurance. It doesn’t cost that much because most people do not die before it expires. Usually, you get it while you have children at home and building your nest egg. Because he had term life insurance, it allowed me to do nothing aside from grieving his loss. I could stay in the house where we lived, and I didn’t have to pack everything up or go through his stuff. Life and all the comforts of our home stayed intact. That allowed me and our daughters just to exist until we could breathe again, eat again, sleep again. I can’t imagine how much more heartache there would have been for us had we had to vacate our home in a hurry.

The biggest reason I am sharing this is I wish to minimize the number of people whose lives are thrown into such a crisis from the loss of their mate. Parents, do this for your children. Think through these things so they don’t suffer more than they already will at your passing. Designate who their guardian will be if both you and your spouse pass. Get that life insurance so those you leave behind will be okay and able to grieve your loss.

Please don’t spend a lot of time imagining what it would be like to lose your spouse. Please go on enjoying your lives together and not being able to imagine spending it with anyone else. But do take a bit to make sure that you have some things in place in case the worst thing ever happens to you.

May 18, 2021